what is IR35?

Around 20 years ago Government noticed that some companies and contractors had found a more tax-efficient way of doing business. By engaging with individuals via “Personal Service Companies” (PSCs), rather than on a self-employed basis, both parties were able to save a bit of money.

This method generates savings for the paying businesses. By working with PSCs, they don’t need to deduct tax under the PAYE System or pay employer’s national insurance contributions. They can also create significant HR costs savings, by avoiding any additional employee benefits. On the other hand, this model allows individuals more flexibility regarding how profits are withdrawn from the PSC, which can be used to create tax savings.

Sound too good to be true? That’s because it is! If PSCs aren’t used legitimately, Government deems these ‘savings’ to be tax avoidance, and IR35 is their weapon of choice.

what is a personal service company?

A PSC is a limited company incorporated by a contractor, through which they provide services to their clients. The contractor is often the PSC’s only shareholder and director.

how does it work?

Luckily for us, there is a (relatively) simple test to see whether your PSC use is allowed. It goes like this:

Imagine your company has engaged with a contractor. If that person had engaged with your business directly, would they have been regarded as an employee? If the answer is yes, IR35 rules require that employment taxes and NICs be paid. If the answer is no, you’re all good.

Whether or not you’d be regarded as an employee depends on lots of factors. In this article, we’re going to focus on who could be caught by the law, and the things you can do to avoid being caught.

20 years on – what’s new?

At the moment, the onus is on the PSC to determine whether IR35 applies. In April 2021, this is changing, and the onus will rest with the buying business. If your business engages with PSCs, the responsibility to decide whether that contractor falls within IR35 is now yours. Moreover, the liability for outstanding PAYE and NIC payments is also yours!

If you run a medium-to-large company that uses contractors, your in-brain alarm bells should now be ringing. Don’t worry, we’ve got you.

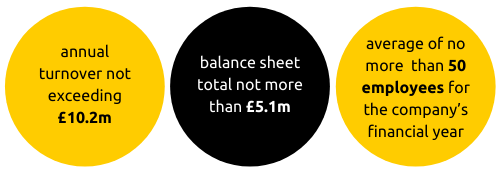

Luckily for those who run “small businesses”, you are actually exempt from these rules! A business is defined as “small” if it satisfies two or more of the following:

… there may be some other requirements to ensure you come within the small companies’ exemption, so check carefully. If you’re unsure, give us a shout.

how to tell if your contractor might trigger IR35.

Deciding whether or not a person is employed has been a convoluted area of law for a while now. That said, there are a few factors that courts tend to focus on, and this is a good starting point:

- Mutual intention – Do both parties intend for their relationship to be that of contractor and client? If so, this would suggest that this isn’t an employee-employer relationship.

- Control – Does the business have control over what work the contractor does, and how, when, and where they complete their work? The more control, the more likely the contractor is to be an employee.

- Mutuality of obligation – Is there a commitment for the company to give the contractor work? Is the contractor obliged to say yes? Do they have an open-ended relationship (as opposed to a fixed-term contract)? If the answer to any of these is “Yes”, this is evidence of an employment relationship.

- Substitution – Is it possible for the contractor to swap themselves out for somebody else? If not, this could be evidence that they’re an employee.

- Financial risk and reward – If the contractor is paid a regular wage, and not exposed to the financial risks of running their own company, this may suggest they are an employee.

- Equipment – employees are generally given equipment, whereas contractors often supply their own.

- Becoming part of the organisation – Does the contractor take part in the organisation, e.g. managing or training the client’s staff? This is considered employee-like behaviour.

- Employee benefits – does the contractor receive holiday pay, sick pay, membership of a firm’s pension scheme, etc? If so – you guessed it – they’re possibly an employee.

If you think that one or more of these factors applies to your contractor, they could be considered a “disguised employee” as per IR35, and you could be liable to pay!

does that mean we can’t hire contractors anymore?

IR35 is intended to stop people from avoiding making payments they would otherwise have to pay. It is not intended to draw a line through the role of contractors, many of whom use companies perfectly legitimately. There are a few simple steps that will help you to show the court that your contractors are not employees.

Let’s start with the relationship between you and the PSC. By considering the following, you could help prove that your contractors are not employees:

- Ensure that as little control as possible is exercised over the PSC or contractor;

- Avoid clauses that compel the company to provide work, or the PSC to accept it;

- Enter a clause allowing the contractor to substitute out for somebody else;

- Structure payments so that they are based around the completion of projects, rather than regular salary-like payments;

- Do not provide the contractors with equipment;

- Try not to give your contractors any wider responsibility in the business, other than their contracted tasks; and

- Do not provide unnecessary perks which could be considered benefits.

where should I start?

I hear you. This is all good and dandy, but where on earth do you start?

Well, we would recommend that you start by creating a detailed list of all of the contractors that you use. Move through that list, one contractor at a time, applying the same factors that the courts will (listed above!). Try not to overcomplicate things and just use good old-fashioned common sense.

There are some handy tools on the gov.uk website here, along with information to show you how to complete a Status Determination Statement for each contractor here.

If you are still concerned about the implications of IR35, we would be more than happy to help. You only have until April, so give us a call and we’ll help you to create a simple, point-by-point plan.